Matthias Müller, Partner Restructuring and Finance, Dr. Wieselhuber & Partner GmbH

From Stress to Strength: Restructuring for Financial Resilience of Automotive Suppliers

Understanding the Real Position

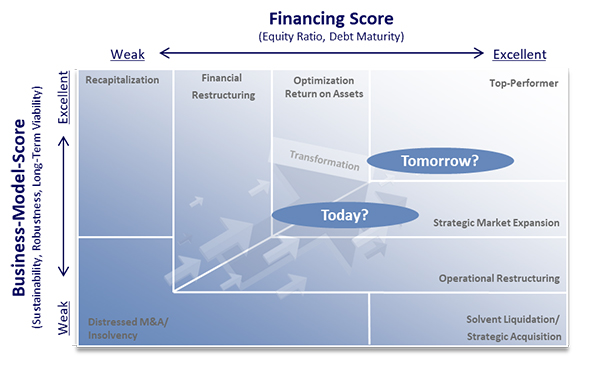

The situation in the automotive supply industry is shaped by significant investment requirements alongside increasing financial pressure. Electrification, software integration and new platform architectures demand capital, while fluctuating call-offs, pricing pressure and a more cautious lending environment place strain on liquidity. Companies must secure stability in the short term while positioning themselves for a market that is evolving in both scale and structure.

A realistic understanding of the company’s position is essential. This means examining earnings quality, cash generation capacity, balance sheet resilience and the contribution each business unit makes to the overall strategy. It often becomes clear that pressure does not originate in the core activities but in legacy units that no longer contribute sustainably to value creation. These areas can absorb capital and management time that would be better invested in future-oriented capabilities.

When History Meets Strategy

In family-owned automotive suppliers, this can be a sensitive topic. Certain business units carry emotional significance and are associated with past phases of growth or regional responsibility. When identity and economic logic overlap, discussions can become difficult. A structured and independent viewpoint can help to realign decision-making with the long-term competitiveness of the group rather than the history of individual parts of the business.

Choosing the Path That Strengthens the Group

Once the position is clearly understood, the effectiveness of ongoing and planned initiatives can be assessed. Measures that genuinely strengthen margin resilience, operating flexibility and customer positioning matter more than incremental adjustments. Transparency across the income statement, balance sheet and cash flow reveals where targeted restructuring is necessary to prevent financial strain from spreading across the group.

At this stage, strategic options become comparable. These may include operational redesign, realignment of the product portfolio, carve-out and sale of non-core activities or a carefully managed wind-down. In situations where stability and continuity need to be secured under time pressure, or where stakeholder alignment is complex, court-supervised restructuring or the use of pre-insolvency restructuring frameworks can help preserve value. The suitability of each path depends on the specific industrial, financial and stakeholder context.

For the analysis to be meaningful, one requires a clear and comparable assessment of the available courses of action. Based on long-standing experience in financial advisory, corporate restructuring and insolvency practice, it is possible to develop a well-founded scenario evaluation that clarifies opportunities and risks, the economic impact and the strategic implications of each alternative. This provides the basis for decisions that are both transparent and aligned.

Restructuring Alone Does Not Create a Future

Reducing exposure alone does not create resilience. Companies that only scale back risk becoming increasingly interchangeable and losing pricing power. Renewal is essential. If capital released from non-core activities is used to develop new competencies, deepen technological relevance or strengthen strategic customer positions, the business regains weight and direction.

Resilience arises from two movements that must be coordinated: letting go where sustainable value creation is no longer possible and investing where the company can build future relevance. This requires practical planning, disciplined implementation and thoughtful alignment with banks, shareholders, employees and customers. Companies that manage this regain the ability to shape their own path rather than being shaped by circumstance.