How automotive suppliers turn crisis pressure into liquidity, innovation and long-term competitiveness.

Matthias Müller, Partner Restructuring and Finance, Dr. Wieselhuber & Partner GmbH

Dr. Dirk Artelt, Managing Partner Industrial Goods and Automotive, Dr. Wieselhuber & Partner GmbH

1. When Transformation Meets Pressure

The automotive supply industry is under historic pressure. Electrification, digitalization and sustainability requirements are reshaping value chains, while inflation, volatile call-offs and financing constraints are compressing margins and liquidity. Many suppliers are struggling to balance transformation investments with short-term financial stability.

At the same time, traditional commercial banks are increasingly withdrawing from the sector, reducing credit exposure and tightening risk criteria. This structural shift in financing markets further limits access to liquidity precisely when suppliers need it most – to stabilize operations, fund innovation and manage volatility.

However, crisis and transformation are not opposites. If managed systematically, short-term stress can become a catalyst for structural improvement, turning liquidity pressure into financial resilience and innovative strength.

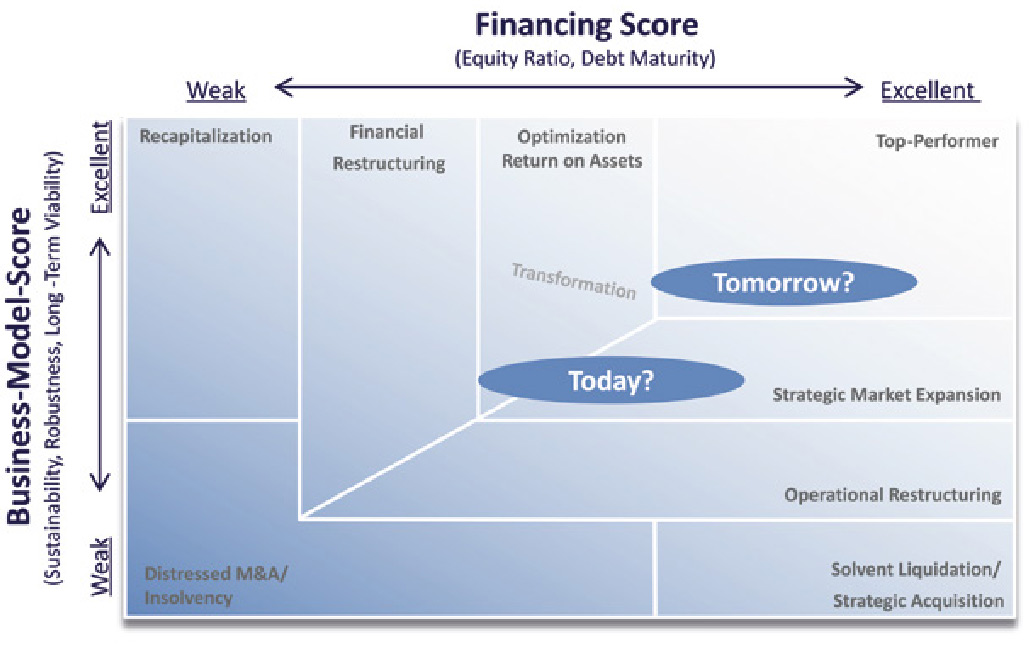

2. Creating Transparency: Assessing Position and Potential

Every restructuring and transformation process begins with a clear understanding of the current position. The foundation is a pragmatic and well-founded assessment of the status quo: Where does the company stand today in terms of its business model and financing structure?

Two analytical dimensions form the core of this assessment:

- Business Model Score: evaluation of the robustness, cash generation capacity and future viability of the business model.

- Financing Score: analysis of equity strength and debt maturity as key indicators of stability and crisis sensitivity.

Together, these dimensions provide a concise view of both the company’s operational performance and its financial resilience. They answer the essential question: How robust is the business model – and how stable is the financing architecture that supports it?

Once this position is defined, ongoing and planned transformation projects are mapped into the model. This reveals how each initiative contributes to strengthening either the business model or the financing structure, and where gaps or additional fields of action remain.

Based on this analysis, a target scenario is developed that quantifies the impact of the transformation on the income statement, balance sheet and cash flow. This target scenario becomes the anchor for strategic alignment, prioritization of further measures and structured communication with key stakeholders.

By linking transparency with strategic direction, the company turns diagnosis into dialogue – and establishes a measurable path from short-term stabilization to long-term financial resilience.

3. When Financial Covenants Are at Risk

In times of stress, financial covenants such as leverage, equity ratio or interest coverage are often the first early-warning indicators of structural imbalance. A potential breach does not necessarily mean failure, but it must be managed with precision and foresight.

From recent restructuring cases several practical lessons can be drawn:

- Understand the implications. Especially in bilateral financing structures, one covenant breach may trigger cross-default effects in other contracts, including factoring, leasing or supplier-financing agreements. Every interdependence must be understood before entering discussions.

- Communicate early. Transparency towards financing partners should begin as soon as a breach becomes likely, not after it has occurred. Delayed communication undermines trust; proactive dialogue maintains credibility and optionality.

- Be transparent. Clearly explain the reasons behind deviations and present realistic countermeasures. Transparency builds confidence and shows that management remains in control.

- Adopt a forward-looking stance. Update the financial plan and scenario analyses early. Bankers rarely ask, “What happened?” – they ask, “What will happen next quarter?” Demonstrating foresight is the single most important trust factor.

- Safeguard liquidity. Regardless of the covenant concerned, liquidity must be ensured under all scenarios. “Cash is king” remains the guiding principle in every restructuring.

- Keep the long-term perspective. Covenant discussions are not only about short-term waivers. They are part of a broader dialogue about the company’s transformation path and future viability.

Experience shows that most banks do not terminate financing merely due to a covenant breach. Their intent is to bring management to the table and jointly evaluate options. Calm analysis, disciplined communication and a clear liquidity plan are far more effective than defensive reactions.

4. From Transparency to Action: Turning Stress into Structure

Once the initial position is clear, the focus shifts from analysis to implementation. Typical stress patterns in the automotive supplier industry include liquidity bottlenecks caused by uneven OEM call-offs and high working capital, margin pressure from rising material costs and price rigidity, investment strain due to electrification or automation, as well as tightened financing terms and covenant restrictions.

Addressing these challenges requires an integrated, interdisciplinary process that combines financial, operational and strategic measures. Key elements include:

- Liquidity planning: rolling 13-week cash forecasts to ensure solvency and negotiation capability.

- Integrated business planning: linking P&L, balance sheet and cash flow to ensure funding adequacy.

- Restructuring concepts: developing financial turnaround roadmaps with measurable milestones.

- Comparative analyses: quantifying continuation versus liquidation scenarios for stakeholder alignment.

- Operational implementation: translating financial targets into performance and footprint measures.

- Financial advisory and M&A: structuring refinancing, asset-based lending or selective divestments to restore flexibility.

This systematic approach transforms reactive crisis management into structured, data-driven decision-making.

5. Financing Transformation: The Missing Link

In many companies, restructuring and innovation are treated as separate topics, one defensive, the other offensive. In reality, however, they are mutually dependent: without innovation, restructuring remains temporary; without restructuring, innovation remains unfunded.

Automotive suppliers therefore need financing structures that support both stability and transformation. Alongside classical bank loans and syndicated facilities, alternative instruments are increasingly relevant:

- Factoring and leasing to free tied-up capital

- Asset-based lending secured by inventories or receivables

- Private debt, mezzanine or continuation funds to close equity gaps

- OEM or strategic investor participation models to stabilize critical suppliers

Integrating such elements into the financial architecture enables suppliers to fund new technologies even under pressure, thereby securing the link between liquidity, innovation and long-term competitiveness.

6. The Restructuring Advisor as a Transmission Belt for Transformation

Restructuring advisors play a crucial intermediary role between financial stabilization and strategic renewal. Their tools, from liquidity and integrated business planning to comparative analyses and operational implementation, form the transmission belt that translates financial recovery into lasting transformation.

Through structured planning, they provide a quantitative foundation for decision-making: Which product lines can be financed? Which sites are sustainable? Which investments generate the highest cash impact. By integrating refinancing and M&A processes, advisors align short-term liquidity measures with long-term portfolio strategy. They turn transparency into traction, ensuring that every step in the restructuring process contributes to the company’s future viability.

In this capacity, the restructuring advisor bridges multiple disciplines: economics, law, operations and corporate finance. The goal is not only to repair what is broken but to design a financial and operational architecture that can carry innovation. Restructuring thus becomes the operating system for transformation.

7. Continuous Transformation: Managing Change as a System

In the automotive sector, restructuring is no longer just a one-time crisis response, but a continuous management responsibility. Market volatility, technological change and supply dependencies demand permanent financial steering.

The dual perspective of business model quality and financing architecture provides a simple yet powerful framework for this purpose. It helps companies visualize where they stand, prioritize transformation projects and communicate clearly with lenders and investors. Over time, this transparency builds trust both internally and externally and becomes a key component of long-term competitiveness.

8. Conclusion: From Stress to Strength

Crisis and transformation are two sides of the same coin. Automotive suppliers that manage to quantify their financial resilience, align stakeholders and fund innovation systematically can turn pressure into progress.

Restructuring, in this sense, is not about short-term survival but about designing financial structures that enable long-term agility and competitiveness. Transparency becomes the bridge between liquidity management and innovation strategy.

Those who master this balance will not only withstand the transformation of the automotive industry but help shape its future.